|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

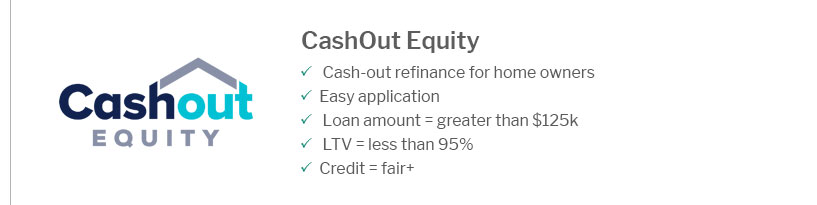

Understanding Refinance Rates in Wyoming: Key Factors and BenefitsRefinancing your home loan in Wyoming can be a smart financial move, but understanding the nuances of refinance rates is crucial. This guide delves into the factors affecting these rates and how they can benefit homeowners. Factors Influencing Refinance RatesSeveral elements determine the refinance rates you might encounter in Wyoming. Here are the most significant factors: Credit ScoreYour credit score plays a vital role in the refinance rate you receive. A higher score typically means better rates. Loan-to-Value Ratio (LTV)The LTV ratio can impact your refinance rates significantly. Lower LTV ratios often lead to more favorable rates.

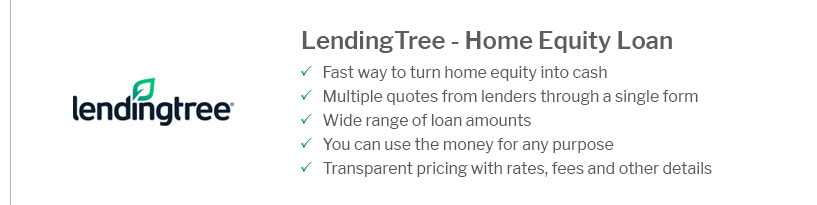

Benefits of Refinancing in WyomingRefinancing can offer numerous advantages, making it an attractive option for many homeowners. Lower Monthly PaymentsOne of the main benefits of refinancing is the potential to lower your monthly mortgage payments. Access to CashThrough a cash-out refinance, homeowners can access equity built up in their home. This can be particularly beneficial for funding renovations or paying off higher-interest debt. For those considering a simple refinancing process, the easy refinance home loan option might be worth exploring. Types of Refinance Loans AvailableUnderstanding the different types of refinance loans can help homeowners choose the best option for their needs. Rate and Term RefinanceThis is the most common refinance type, where the loan's interest rate and term are adjusted to reduce payments. Cash-Out RefinanceA cash-out refinance allows you to convert home equity into cash, which can be used for various financial needs. FHA 203k RefinanceThe fha 203k refinance loan is perfect for those looking to renovate or improve their homes while refinancing. Frequently Asked Questions

https://www.nerdwallet.com/mortgages/mortgage-rates/wyoming

Offers a full selection of mortgage types and products, including jumbo, home equity, and government loans. Claims to offer preapproval within 24 hours of loan ... https://www.bankrate.com/mortgages/mortgage-rates/wyoming/

As of Friday, January 24, 2025, current mortgage interest rates in Wyoming are 6.83% for a 30-year fixed mortgage and 6.18% for a 15-year fixed mortgage. https://www.usbank.com/home-loans/mortgage/mortgage-rates/wyoming.html

Compare Wyoming mortgage rates. The following tables are updated daily with current mortgage rates for the most common types of home loans.

|

|---|